Essentials Cheaper as GST Slabs Cut in India

New Delhi, September 5, 2025 —

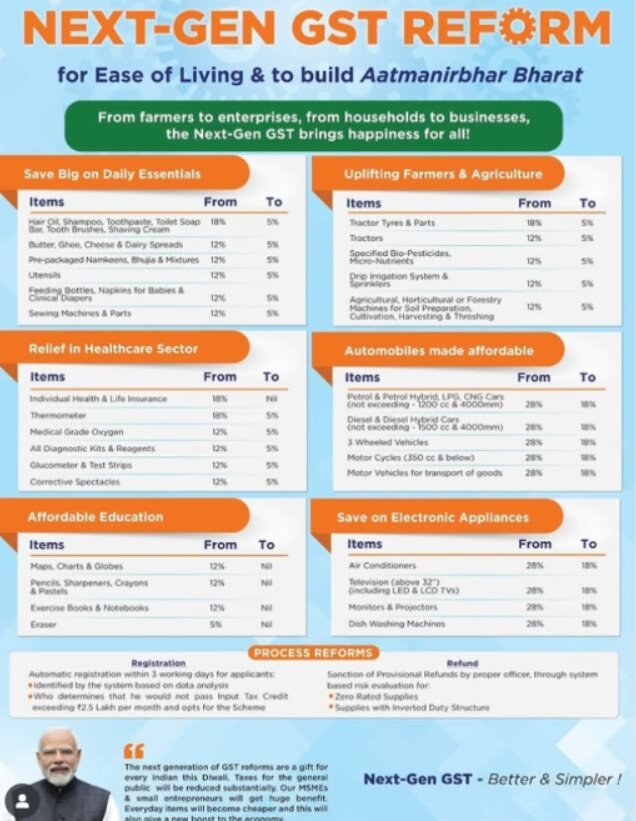

India’s tax landscape is set for a major transformation following the 56th GST Council meeting held on September 3–4. The council introduced a series of sweeping reforms designed to simplify the tax structure, reduce costs for everyday goods, and make essential services more affordable for all.

Starting September 22, 2025, the new GST framework will come into effect, bringing clarity and relief across sectors—from agriculture and healthcare to retail and construction.

What’s Changing?

New Tax Slabs Introduced:

- 5% for merit goods

- 18% for standard goods

- 40% for sin and luxury items (e.g., tobacco, luxury cars)

This tiered approach aims to balance affordability with accountability, ensuring that essential items remain within reach while luxury consumption is taxed appropriately.

GST Exemptions That Matter

Several categories have been granted full exemption from GST, marking a significant shift in policy:

- Life & Health Insurance: Now completely tax-free

- Essential Food Items: Roti, paneer, UHT milk, and Indian breads will carry 0% GST

- Medicines: 33 lifesaving drugs and 3 treatments for cancer and rare diseases are now GST-free

These exemptions are expected to ease financial pressure on families and improve access to healthcare and nutrition.

Lower Rates, Bigger Savings

The council also approved rate reductions across multiple categories:

- Consumer Electronics: TVs, ACs, dishwashers, and small cars drop from 28% to 18%

- Daily Essentials: Hair oil, soaps, shampoos, and kitchenware now taxed at 5%, down from 12–18%

- Agricultural Machinery: Tractors and threshers reduced from 12% to 5%

- Construction Materials: Cement now taxed at 18%, down from 28%

These changes are expected to reduce household expenses and encourage spending, especially ahead of the festive season.

Impact on Ground Level

The reforms are expected to benefit:

- MSMEs: Lower compliance costs and simplified filing

- Farmers: Reduced input costs for machinery

- Small Traders: Easier inventory management and pricing

- Retail Consumers: More affordable goods and services

Major retailers, including Reliance, have already pledged to pass on the benefits to customers, ensuring that the impact is felt at the checkout counter.

Festive Boost Ahead

With Navaratri and Diwali around the corner, the timing of these reforms couldn’t be better. Lower prices on consumer goods and essentials are expected to drive demand and boost domestic consumption.

What This Means for You

Whether you’re a small business owner, a farmer, or a family planning festive purchases, the new GST structure promises:

- Simplified Tax Filing

- Lower Prices on Essentials

- Greater Transparency in Pricing

- Improved Access to Healthcare and Nutrition

A Step Toward Inclusive Growth

The GST Council’s decision reflects a broader commitment to inclusive economic growth. By reducing the burden on essential goods and services, the reforms aim to uplift underserved communities and stimulate grassroots development.

Looking Ahead

As the new rates take effect, industry experts anticipate:

- Increased consumer confidence

- Higher retail footfall

- Stronger rural demand

- Improved compliance across sectors

The council has also hinted at further simplifications in the coming months, including digital filing support and real-time invoice tracking for small businesses.

Final Word

This reform isn’t just about numbers—it’s about people. It’s about making everyday life more affordable, ensuring that families can access what they need without financial strain, and helping businesses thrive in a fairer, simpler tax environment.